The SBA seven(a) personal loan is the preferred personal loan plan. Mortgage proceeds could possibly be employed for any number of certain uses, together with: new construction, growth or renovation, or to purchase land or structures; to invest in gear, fixtures, leasehold enhancements; Doing work capital; for just a seasonal line of credit score, stock or beginning a company; and even to refinance personal debt for powerful reasons.

SBA Bank loan Calculator is actually a tool to estimate the month to month payments for just about any SBA business loans. The SBA financial loan amortization timetable exhibits the desire and principal payments of each and every month.

Note: The commercial house loan calculators displayed In this particular Internet site must be employed like a guideline and do not characterize a determination to lend. Industrial Bank loan Immediate and CLD Fiscal, LLC are certainly not chargeable for any calculation errors resulting from the usage of these calculators.

SBA 504 fee: Determined with a regular monthly basis and stuck at some time on the debenture sale. Level for existing thirty day period is shown higher than.

Of course, as we just discussed, you, because the borrower will probably be required to place down 10% of your loan amount of money (a larger down payment is usually needed for startups or Particular use properties).

Of the many SBA systems, the CDC/SBA 504 financial loan is among the preferred—predominantly mainly because it delivers unique Added benefits to companies that qualify. SBA 504 loans are all about fueling the overall economy—they help business owners purchase land or buildings, strengthen existing facilities, buy machinery and equipment, or purchase https://nsdc.com/sba-504-calculator/ professional real estate. Furthermore, they promote position advancement in regional communities.

Organization financial loans Use a few advantages. By acquiring a personal loan, the lender does not have fairness while in the enterprise. In its place, you just have to repay the principal additionally fascination.

“During the bridge period of time, the borrower could make payments to the bridge lender right,” says McGinley. “But as soon as the bridge loan is paid out off with the SBA debenture, the borrower can make payments straight to the CDC.”

Repayment conditions are based on the arrangement between your small business and your company lender. Repayment periods can range between as shorter as 6 months to provided that five yrs or more.

All round, equally the CDC as well as lender lender should be able to impose their own SBA 504 bank loan prerequisites to determine if your enterprise is qualified.

The SBA mortgage calculator by Ramp is a handy Instrument that can support little entrepreneurs in estimating their possible financial loan payments and All round expenditures.

When your SBA bank loan is approved, the lender will mail the cash towards your banking account. This normally takes anywhere from a few days to a few months, but most loans just take about 5 times. Everything will depend on the lender as well as their acceptance procedures. From there, You should use the resources for the stated goal.

We provide financing in all fifty states. Please Notice we have been only licenced to operate with Houses that happen to be zoned business.

Lendio isn’t your normal lender. In truth, it doesn’t supply financial loans in any way. Puzzled concerning why they designed our listing? Visualize them as being the Kayak or copyright of small business financial loans.

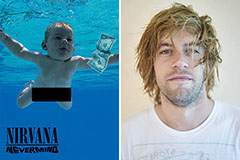

Spencer Elden Then & Now!

Spencer Elden Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!